Uber Safari has entered Kenya’s KES 4.3 billion tourism market, arriving as visits to its flagship Nairobi National Park surged by 24% in the first half of 2025. This new app-based service for short game drives represents a significant operational shift for the local tour industry.

This analysis by Kenya Peaks Adventures examines the economic and competitive impacts of Uber's new model on Kenya's safari sector.

Key Takeaways

- Uber Safari is a short, urban tour product for Nairobi, not a traditional multi-day safari.

- Operators can earn higher profit margins on these short tours than on longer safaris.

- The app gives small operators a new way to reach a large base of potential customers.

- Its fixed pricing will likely create price competition among Nairobi-based day tour providers.

- The service could increase traffic and environmental pressure on Nairobi National Park.

Understanding the Uber Safari Model

Uber Safari is a new product that provides scheduled, three-hour game drives within Nairobi National Park. Clients book the service through the standard Uber app, choosing between a day or night tour in the only wildlife park located inside a capital city.

The service is a pilot project for Uber in Kenya, introduced to coincide with the company's tenth year of operations in the country and follows a similar launch in Cape Town.

The model is built on a partnership with the Ministry of Tourism, the Kenya Wildlife Service (KWS), and the Tourism Regulatory Authority. Instead of using its own vehicles, Uber provides the platform for existing licensed tour operators and fleet partners to list their vehicles.

This approach connects established safari operators with a broad digital customer base. Early media and tourism authority reactions have noted the convenience of booking a wildlife tour through a familiar app.

The service is designed to be pre-booked, with reservations required between two and ninety days in advance. Here are its key operational features:

- Pricing: Daytime tours cost KSh 25,000 (around US$165) per vehicle for up to seven passengers. Night tours cost KSh 40,000 (around US$265) for up to five passengers.

- Inclusions: The fee covers the vehicle, a driver-guide, and pickup and drop-off. Night tours also include a KWS warden for safety and guidance.

- Exclusions: Passengers are required to pay their own park entry fees separately. For foreign tourists, this is US$35, while citizens and residents pay KSh 400.

- Booking and Payment: All bookings and payments are handled digitally through the Uber app.

Uber's target market for this service includes domestic tourists and the large number of business travelers in Nairobi who may have limited time for a full safari.

By offering a quick and accessible wildlife experience, Uber aims to capture a portion of Kenya's tourism income, which reached KES 4.3 billion. The company's own contribution to Kenya's economy was reported at KES 14.1 billion in 2023, with tourism activities making up about a fifth of that total.

Traditional Safari Operations vs. The Uber Safari Model

The Uber Safari product operates in a fundamentally different market segment than traditional Kenyan safaris. A classic safari is a multi-day, immersive experience that involves complex logistics, extensive travel, and all-inclusive pricing. These tours typically cover major national parks like the Masai Mara, Amboseli, or Samburu, which are located hours away from the capital. In contrast, Uber Safari offers a brief, localized excursion in a park that is uniquely situated within city limits.

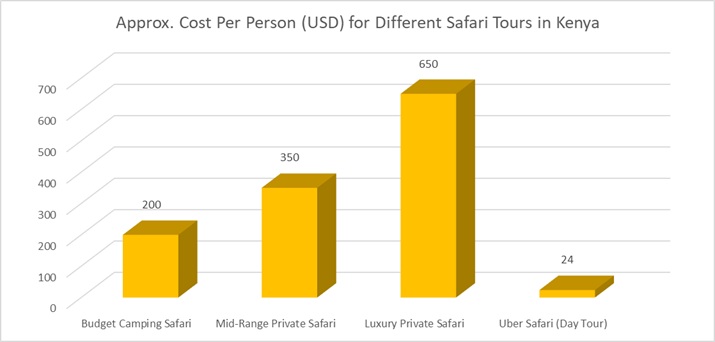

Pricing for traditional safaris is usually quoted on a per-person, per-day basis and covers a wide range of services. The cost structure reflects the logistical complexity and duration of the trip.

The table below illustrates the typical price bands for multi-day safaris compared to the fixed-price Uber Safari model.

| Safari Type | Approximate Cost (USD) | Basis |

|---|---|---|

| Budget Camping Safari (Group) | $200 | Per person, per day |

| Mid-Range Private Safari | $350 | Per person, per day |

| Luxury Private Safari | $650+ | Per person, per day |

| Uber Safari (Day Tour) | $165 | Per vehicle (up to 7 people) |

The significant price difference is driven by several factors that are central to the traditional safari model but absent from a short urban tour. These cost drivers dictate the final price for the traveler and shape the financial viability for operators.

- Park Fees: Entrance fees for premier parks are a substantial expense. The Masai Mara National Reserve, for example, charges between US$100 and US$200 per adult per day, depending on the season. This fee alone can be nearly 30% of a safari's total cost. Nairobi National Park's fee of US$35 for foreign visitors is comparatively low.

- Accommodation: For multi-day trips, lodging is the single largest cost component. Prices vary dramatically from basic campsites to five-star luxury lodges, and these costs, along with park fees, can account for over half the total price of a safari package.

- Vehicle and Fuel: Traditional safaris require specialized 4x4 vehicles, such as Land Cruisers, which cost around US$120 per day to hire with a driver. Long-distance travel between parks and full-day game drives consume significant amounts of fuel.

- Operational Overheads: Operators must cover driver-guide wages (KSh 2,000–3,000 per day), their accommodation and meals on overnight trips, vehicle maintenance, insurance, and marketing costs.

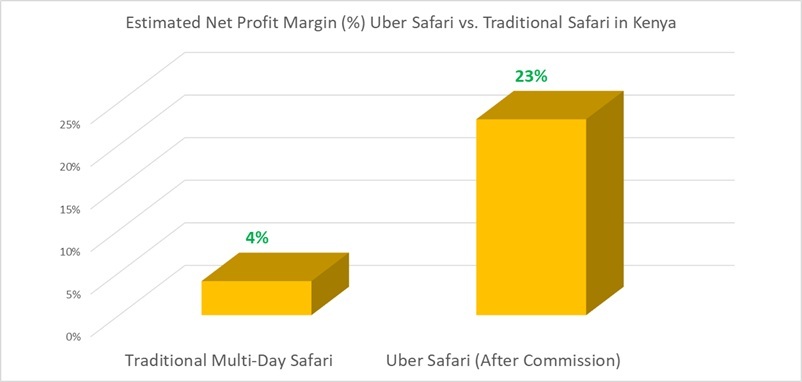

Despite the high prices charged to clients, local tour operators often work with very slim profit margins. A 2025 cost analysis showed that many local companies apply a markup of just 10–15% to their net costs, leaving them with a final net profit of only 3–5%.

Their business model depends on securing a high volume of bookings and operating efficiently. When these safaris are booked through international agents, those agents add their own markups ranging from 20% to as high as 300%, which explains the vast price differences for similar itineraries found online.

The Economics of a Nairobi National Park Tour

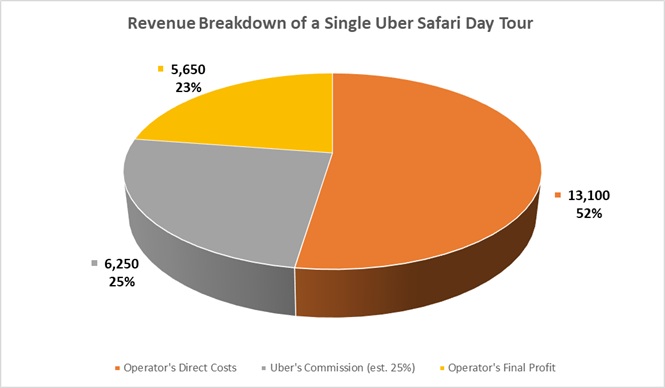

An economic analysis of a single Uber Safari trip reveals a highly profitable model for participating tour operators, standing in sharp contrast to the low-margin nature of multi-day safaris. The fixed revenue and relatively low, predictable costs of a three-hour tour in Nairobi National Park allow for significantly higher returns. The revenue for a daytime tour is set at KSh 25,000, while a night tour generates KSh 40,000.

To understand the profitability, we can break down the estimated costs an operator would incur for a standard day tour. These costs are primarily variable and directly tied to the single trip, unlike the extensive overheads required for managing multi-day excursions.

| Cost Item | Estimated Cost (KSh) | Notes |

|---|---|---|

| Vehicle Hire (4-hour share) | ~5,940 | Based on a daily rental rate of US$120 for a 4x4 Land Cruiser. |

| Driver-Guide Wage | ~3,000 | Based on the daily rate for a professional safari guide. |

| Fuel | ~2,140 | Calculated for a round trip of approximately 90 km. |

| NNP Vehicle Entry Fee | 300 | Standard fee for a vehicle with fewer than six seats. |

| KWS Guided Tour Fee | 1,720 | Required fee for a guide for up to four hours. |

| Total Estimated Costs | ~13,100 |

With a revenue of KSh 25,000 and estimated costs of KSh 13,100, an operator's gross profit is approximately KSh 11,900 per trip. This translates to a gross profit margin of about 48%. The night tour is even more lucrative. While the costs rise slightly to cover a higher KWS warden fee (KSh 2,155), the KSh 40,000 revenue yields a gross profit of around KSh 26,500, representing a margin of roughly 66%.

This gross profit does not account for Uber's commission. Uber typically charges its partners a commission of around 20–25%. If we assume a 25% commission on the KSh 25,000 fare (KSh 6,250), the operator's final profit margin would be reduced from 48% to about 23%. While lower, a 23% net margin on a single, short trip is still substantially healthier than the 3–5% net profit operators make on complex, multi-day safaris. This illustrates the financial appeal of the high-volume, low-overhead Uber Safari model for local operators with available vehicles.

Opportunities and Pressures for Local Tour Operators

The introduction of Uber Safari creates a new set of conditions for local tour companies in Nairobi. For some, the platform offers a path to new customers and increased revenue. For others, it introduces significant competitive pressure that could reshape the market for day tours in and around the capital. The effects are best understood by examining both the opportunities and the challenges operators now face.

For many small and medium-sized tour businesses, the platform presents several clear advantages. These operators often have limited marketing budgets and rely heavily on traditional booking channels. Uber's entry provides them with a powerful alternative.

- Access to a New Distribution Channel: The Uber app connects operators directly to a large, global customer base. This allows businesses with under-used vehicles to fill empty seats and generate bookings during slower periods without significant marketing expenditure.

- Transparent Pricing and Digital Payments: The fixed fares for day and night tours establish a clear market price, simplifying quotes. Payments are handled securely through the app, which eliminates the risk of non-payment and streamlines the accounting process for operators.

- Upsell Potential: An Uber Safari trip can serve as an introduction to a tour company's services. A business traveler who enjoys a three-hour game drive may be inclined to book a longer weekend safari to the Masai Mara or Amboseli with the same operator, turning a small booking into a more substantial sale.

- Support for Local Employment: By partnering with existing licensed operators and requiring KWS guides, the model supports local jobs in the tourism sector. The growth of accessible micro-tours can also stimulate more interest and spending in domestic tourism.

At the same time, the service introduces new challenges that could disadvantage some operators and alter the competitive environment. The platform's scale and standardized model create pressures that will force local companies to adapt.

- Price Competition: Uber Safari’s fixed price of KSh 25,000 for a half-day tour sets a new and highly visible benchmark. Competing operators who are not on the platform may be forced to lower their prices to stay competitive, potentially eroding their profit margins.

- Commission Squeeze: While profitable, operators must give Uber a commission of 20–30% of the fare. This reduces the overall profitability compared to a direct booking. Operators must weigh this cost against the volume of business the platform can generate.

- Standardization vs. Customization: The service offers a fixed three-hour product. This may put pressure on operators who specialize in providing tailored experiences, such as tours focused on photography or bird-watching with flexible timings. Clients looking for unique, customized trips may still prefer traditional operators, but the market could shift toward standardized tours.

- Vehicle Standards: To join the platform, operators may need to meet specific quality and safety standards for their vehicles. This could require capital investment for companies with older fleets, creating a barrier to entry.

Broader Implications of Uber Safari for Tourism Sector in Kenya

The arrival of Uber Safari extends beyond the immediate competition among Nairobi tour operators, carrying wider implications for Kenya's national tourism strategy, digital evolution, and conservation efforts. While its current scope is limited to a single park, its model introduces trends that could influence the sector's future direction.

One of the most significant potential long-term benefits is its role as a "gateway product" for the broader Kenyan safari experience. International business travelers or tourists on a tight schedule, who might otherwise not consider a safari, can now easily book a short tour.

A positive experience in Nairobi National Park could inspire them to return for a more extensive multi-day safari in other iconic reserves like the Masai Mara or Amboseli. This could help expand the overall market, benefiting lodges, guides, and operators across the country.

Uber's entry also acts as a catalyst for digital transformation within a sector that has already seen growth from technology. Kenya recorded 2.394 million international arrivals in 2024, with tourism revenues reaching KES 452.20 billion, a 19.79% increase from the previous year. This growth was partly driven by digital marketing and the country's e-visa system. Uber Safari reinforces this trend toward digital convenience. Its success may push more traditional tour operators to adopt online booking platforms and digital payment systems to meet changing consumer expectations and remain competitive.

However, the model also raises serious resource management concerns. Nairobi National Park is a relatively small and ecologically sensitive area, covering just 117 square kilometers. The Tourism Research Institute reported a 24% increase in visits to the park in the first half of 2025, a period that coincides with the introduction of Uber Safari.

While a direct causal link isn't proven, the ease of booking through the app likely contributed to this surge. A sustained increase in vehicle traffic could lead to road degradation, disrupt wildlife behavior, and diminish the quality of the visitor experience.

To mitigate these risks, the Kenya Wildlife Service may need to consider new management strategies, such as implementing daily vehicle limits, introducing dynamic pricing for peak hours, or enforcing stricter regulations for night drives to protect the park's fragile ecosystem.

For now, Uber Safari should be viewed as a complementary niche product rather than a disruptor of the entire safari industry. Uber has not announced plans to expand into remote parks, which require complex logistical planning involving accommodation, long-distance travel, and deep local expertise. In these areas, the established networks and specialized knowledge of traditional tour operators remain indispensable.

The service successfully monetizes the unique proximity of a national park to a major city, but its model is not easily transferable to the broader Kenyan safari landscape.